is church preschool tax deductible

However some daycares or preschools associated with churches are organized under entities. Does preschool tuition to a church count as a char.

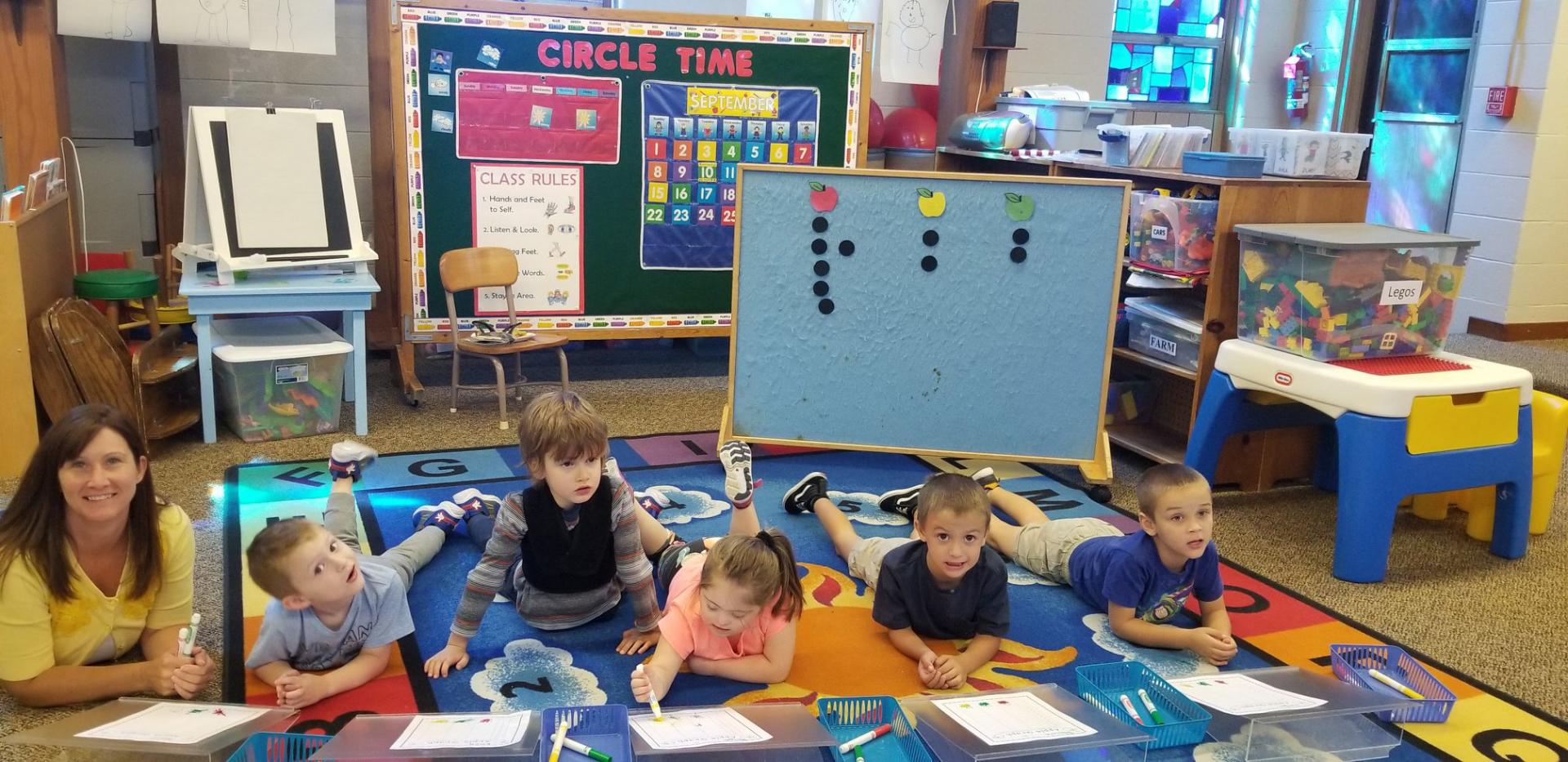

Preschool Campbell Christian Schools

Your contribution is tax-deductible.

. You cannot deduct the costs of counseling litigations or personal. If you qualify for the child care tax credit you are allowed to claim up to 3000 in expenses for one child or up to 6000 for more. And thanks to recent changes in the tax law the benefits for preschool tuition paid during the 2021 tax year are greater than ever before.

For parents who are responsible for childcare handling the cost of bringing up children can be challenging. If you found that the preschool activity produces substantial taxable income compare to the church activity - you may separate the preschool from the church. Most likely your church based child care provider is a tax exempt organization.

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. You must have earned income throughout the year. I have a question about a pre-kindergarten or preschool tax deduction.

29 2004 1159 pm ET. Taxpayers must claim deductions for school donations as well as other itemized deductions on Schedule A of Form 1040. Does preschool tuition to a church count as a charitable donation if we.

Qualifying Child You cant qualify for the credit unless the child in. Up to 25 cash back Only Itemizers Can Deduct Donations. Heres a way for boomers to share the wealth with their children and grandkids.

A colleague asks whether she can deduct as a charitable contribution the tuition payments she makes for her child to attend a. A publication describing in question and answer format the federal tax rules that apply to group rulings of exemption under Internal. Your actual deduction will be a percentage of.

When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. December 18 2021 Tax Deductions. Turn on suggestions.

Is private preschool tuition tax deductible. If say you have 12000 AGI and pay 5000 to put one child in church daycare your deduction would be 35 percent of 3000. Thats why the IRS allows you to.

Have A Qualify Child. Upon request Peoples Church Preschool will provide you with a receipt to demonstrate your gift as a tax-deductible donation. A child must be determined as your qualifying child in order to receive the child and dependent care credit.

Thus the deduction is only. A qualifying child is under the age of 13 and lives with you for more than half of the year. You can only deduct a donation to a church if you itemize your personal tax deductions on IRS Schedule A.

Im pleased to say that under certain circumstances you can indeed claim a tax benefit for preschool tuition. Church Exemption Through a CentralParent Organization A church with a parent organization may wish to contact the parent to see if it has a group ruling. August 20 2021 by Steve Banner EA MBA.

The Gift-Tax Exemption. But before we get too carried away with thoughts of what to do with that. Cover the cost of preschool and shake off gift taxes to boot.

Many churches operate schools and offer tuition discounts to some employees whose children attend the school. Although preschool expenses do not qualify as a tax deduction on their own right you can claim them as part of the child and dependent care credit assuming you qualify. Preschool and day care are not tax deductible but you can be entitled to credits instead which could mean better tax benefits for you Paul Sundin a CPA and tax strategist at.

Publication 4573 Group Exemptions PDF. This greatly limits the. If the parent holds a.

Deductions credits. Some of the most common questions we get are Is private preschool tax deductible and Is catholic school tuition tax deductible In both of these cases the answer will always be no. If your church operates solely for religious and educational.

Ordinarily a taxpayer can only confer 16000 a year for 2022 15000 for 2021 to each grandchild or anyone else for that matter without triggering. You already know that college. IRS Letter Ruling 9821053.

Is preschool tuition tax-deductible.

Business Related Items You Can Write Off On Your Taxes Business Tax Deductions Budget Software Financial Tips

Letter For Donations Donation Letter Donation Letter Template Donation Request Letters

Childcare Spaces Daycare Organization Home Daycare Daycare Setup

The Last Class Zion Lutheran Nursery School In Landisville Is Closing Its Doors After 29 Years Faith Values Lancasteronline Com

How To Make A Daycare Parent Handbook Parent Handbook Family Child Care Daycare Business Plan

How To Write A Child Care Newsletter The Empowered Provider Daycare Curriculum Teacher Newsletter Template Family Child Care

A Tax Credit For Church Preschool Daycare

Can I Deduct Preschool Tuition

Local Child Care Centers Figuring Out How To Safely Reopen Enforce Social Distancing For Kids Local News Lancasteronline Com

Special Needs Preschool Parma Ohio Middleburg Early Education Center

Is Preschool Tuition Tax Deductible Motherly

Daycare Center Paint Idea Wall Colors Childcare Center Classroom Decorations

Starting A Daycare Deductible Expenses For A Day Care Business Bigez Com Startingadayc Small Business Advice Small Business Accounting Starting A Daycare

Can A Pre K Teacher Take The Teachers Deduction On The 1040

Annual Fund Morningside Presbyterian Preschool

Child Care Is Finally Getting Some Much Needed Regulation But It S Still Expensive As Hell Mother Jones